Love Offerings Guidelines

Love offerings (gifts) are complex issues for church administrators. Part of the problem lies in the fact that the IRS does not spell out exactly how churches are supposed to acknowledge and handle them.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Section 102(c) of the tax code tells us that a "gift" shall not include...

"any amount transferred by or for an employer to, or for the benefit of, an employee."

There are 2 exceptions to this rule:

- De minimis gifts...gifts so insignificant in value that accounting for them would be unreasonable or administratively impracticable. [IRC132(e)]

An employee gift of a ham or turkey would be a good example of this

rule. Such a "gift" would not be taxable to the employee...but a

Christmas cash bonus would be taxable. (Cash, gift cards, or other cash equivalents are not de minimis gifts, regardless of how small the value). See more on the tax consequences of staff gifts.

- Employee achievement awards...requires a written, nondiscriminatory award program, which provides awards either upon attaining longevity goals or safety standards and meets other requirements for type of gift and limits on amounts.

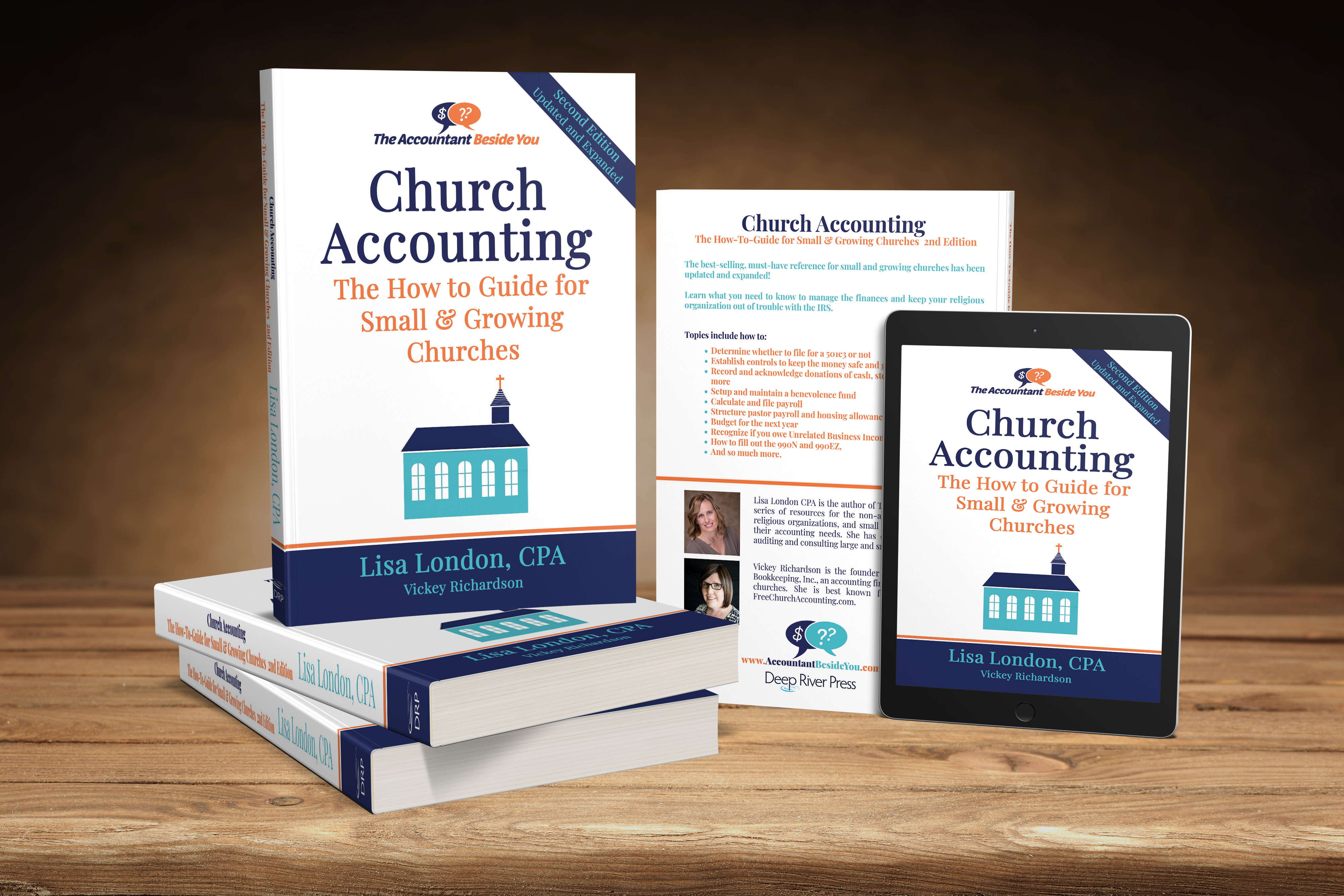

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

Properly Handling Love Offerings:

This How To Book for Churches is packed full of tips for:

- setting up internal controls,

- cash out-controls for debit/credit cards

- setting up an effective fund accounting system,

- handling and tracking contributions,

- setting up compensations for a minister,

- handling a payroll for a church

- preparing nonprofit financial statements,

- and much more.

We also have the following IRS court cases that lay a foundation of guidelines for determining when a "gift" is considered nontaxable to the recipient and nondeductible to the donor:

Duberstein and Bogardus, both Supreme Court decisions; Banks v.Comm, 62 T.C.M. 1611; and an 8th Circuit case, Goodwin v. U.S. 67F.3d 149.

From the preceding cases we find the following guidelines for nontaxable "gifts":

- It cannot be for a service performed

- Must be spontaneous in nature

- Cannot be solicited

- Cannot be a tax deduction for the donor

In the Goodwin case and the Banks case the courts ruled that the special love offerings given to the pastors on special occasions such as Christmas, birthdays, anniversaries, etc. were taxable income based on these factors:

Source of the "gifts".

- The gifts were not spontaneous but part of a "highly structured program" for transferring money to the minister on a regular basis.

- Were made by the whole congregation and not by individual donors.

- Two weeks before the special occasion envelopes were given out for the "gifts" (Goodwin case)

- Gifts were not counted or processed thorough the church's records. (Goodwin case)

Size of the "gifts".

- In the Banks case, the love gifts totaled more than $40,000 annually and were in addition to the pastor's regular salary.

- In the Goodwin case, the love gifts totaled around $12,000 to $15,000 for the 3 audited years. The pastor's salary for those 3 years was $7,800 to $16,835. So the court noted that the gifts were a substantial part of the pastor's overall compensation.

The church members stated they contributed to the special occasion love offerings to show their appreciation, love, and respect for their pastor.

So the court ruled that the offerings were compensation for services rendered (and therefore taxable) rather than a tax free gift proceeding from a "detached and disinterested generosity" (guidelines set from the Duberstein case).

Why should this matter to your church? Well...one of the number one issues that hurt churches in an IRS audit is improperly paying employees or non-employees.

Those weekly or monthly love offerings you give your church musicians or pastors could potentially turn into a financial nightmare for them and your church...because the gifts could be considered payment for a service performed and it definitely is not a spontaneous gift.

So you would need to either include these amounts in their W-2s...or...if over $600 paid annually to "non employees"...send 1099s to these recipients.

Research Love Offerings and Gifts

I know there will be many of you that disagree with me and as I have stated several times....never take what you read on the internet at face value.

Do your own research and for the sake of your church and staff....educate yourself on the proper documentation and handling of love gifts.

However, be aware that even CPAs that do not specialize in church accounting may not know all the complex rules and regulations surrounding churches and related matters such as love offerings. Case in point is this article written by Raul Rivera of StartCHURCH about love offerings given to pastors.

In an article written by Frank Sommerville, JD, CPA, "Benevolence: The right help given the right way" he states:

...“love offerings,” pastoral appreciation gifts, Christmas gifts, anniversary gifts and birthday gifts that flow from the church to the church employee are always taxable. Even retirement gifts are taxable to the recipient. No exceptions to this rule exist.

References:

Dan Busby: Zondervan Church and Nonprofit Tax and Financial Guide

Richard Hammer: Church and Clergy Tax Guide

MINISTRYCPA - COREY A. PFAFFE, CPA, LLC

Comments...

Enter your title of your tip, idea, comment, or question in the text box below.

Keep the title as short as possible, but interesting enough to make people want to click on your title.

Then click on the link below it that says: Click here to see the rest of the form and complete your submission.

Write your post. Elaborate and give all the details necessary to properly convey your meaning or question,

Please be aware that with my bookkeeping company, building and maintaining websites, and my volunteer work at my church, I cannot possibly answer and comment on every submission.

However, your opinions, questions, and comments are very valuable to me...so I will try to answer questions when I can, but I am relying on the goodness of others to help here:)

Important! Comments used to go live without my approval. I would have liked to keep it this way, but there are some that take advantage of that. As a result of their blatant disregard of my request to stop posting their spam on this site... I now must approve comments first. I apologize for this inconvenience and will post your comments asap.

Questions and Comments on Love Offerings

Do you have a question or comment about love offerings? Share it!

Archive of Love Offering Questions (& Answers)

The following comments, tips, and Q/A were provided by FreeChurchAccounting's generous readers:

Christmas Bonus

Our Pastor received a Christmas bonus under $200.00. Do I put the full amount on his W-2 since no taxes were taken out? He qualifies for his regular salary …

Love Gift to Pastor - not related to services performed - reportable?

If a pastor is experiencing high medical costs not covered by insurance and the Board wants to provide them a small love gift (< $3,000) to show support …

Can a church volunteer about to receive a 1099Misc form donate it back to the church

Can a church volunteer about to receive a 1099Misc form choose to donate it back to the church to avoid receiving a 1099-Misc?

A visiting speaker

If an older minister from a different state comes and preaches a few meetings for our local church, is the love gift, that the people gave the church to …

Taxable Gift for Pastor?

We gave our pastor a laptop computer for his 10th anniversary. Is this a taxable gift?

We had donations from the congregation for $660.00 and the price …

Love gift to worship team

if we give a love gift to members of the worship team will we have to issue a 1099-misc if it is over $600.00?

Susan

Weekly designated gift to pastor & W2

This past year, a new member started designating gifts to our two pastors each week.

One is a close relative to whom he gives a couple hundred each …

Taxable Liability for Love Offering/Severance Package

Our church has unfortunately been forced to sell our property and we are in the process of dissolution.

Because our minister is in his early 70's, …

When is a love gift not considered income and considered a gift tax?

Our church for decades has collected a free will offering at the end of the year to gift to our pastor.

It does not go through the church books at …

Financial Gifts to an Unsalaried Pastor

Our pastor is not "full time" and holds another employment.

The church gave him a love offering and financial gifts throughout the year that totals …

Love offerings taxable from other churches?

I recently left my position as a worship pastor at a church in Maryland and are relaunching a church in Arizona as the senior pastor.

In the process, …

Taxable for Pastor, but tax deductible for giver?

I'm still unsure about this. I've read quite a few articles and most tend to agree that the love offering donations are taxable income for the Pastor who …

Non-Cash Gift for Pastor

Our pastor announced his resignation earlier this month. Our deacon board decided to hire someone to paint a painting of our church as a "farewell gift". …

Love Offering/Pastor's Aide for Elderly Retired Pastor

We give a monthly offering to our "founding pastor" who is elderly and does not file taxes.

We describe this offering as pastor's aide.

I understand …

Love Offering during musical performance

I am a member of a musical group considering holding a concert at a local church.

The group is a 501c3 nonprofit.

If the church collects a free …

Christmas Bonus

We gave our pastor a small Christmas Bonus.

My question, is all of the bonus taxable income and nothing from it goes into his Housing Allowance? I'm …

Gifts for Volunteers

Need clarification please! Confusion over employee or not?

If we were to give the children's church leader and the choir director (both volunteers …

Small church guidelines for gifts to pastor

How should a small church (tithes and offerings less than $75000 annually) handle and report monetary gifts to its pastor and immediate family?

The …

Gift for Volunteer Elder

We have an outgoing volunteer elder/pastor. We thought it would be nice to gift him with $2,500.00 gift.

This would come out of our general fund. …

Required Love offering

My organization uses a church building that is offered to us for free.

My organization REQUIRES each family to pay a set amount twice a year as a …

Child care costs

Our worship leader performs the task as a ministry to the church (he takes no salary).

However, he has asked for child care reimbursement, as the time …

"Gifts that flow from the church ...

I don't want to make any assumptions:

1.Pastor announces a special collection to help his colleague(a visitor to the church) start a new church. Cash …

"Love Offerings" for Guest Speakers, Singers, Musicians, Pastor's Birthday

I am trying to get a handle on how to properly process and record donations/contributions received through special offerings specifically designated for …

Retired Clergy Christmas Bonus

We have a retired pastor who receives a small retirement amount that is 100% Housing. He is issued a 1099-R.

If we give the reitred pastor a Christmas …

"Freewill " offering for performing quartet

Our church is planning on allowing a quartet that performs sacred music to hold a concert at the church.

The quartet wants to collect a freewill offering. …

Non staff gifts

We have several Elders who do not receive any compensation throughout the year.

They have no "contract" or "guarantee" of any bonus or Christmas gift. …

Are love offerings and gifts subject to FICA tax?

I understand from what I have read that basically any and all cash gifts to employees are to be added to the employee's W2 form.

Are these gifts simply …

Can the deceased pastor's wife benefit financially from the church?

Our pastor recently passed away and the church voted to give his wife a portion of his salary for 3 months plus pay her long-term care insurance for 2017. …

I have a question about being paid as an ocassional worship leader

I have been trying to find a definitive answer to this question.

I lead worship for a pastor friend of mine occasionally. I receive a check from the …

Reportable amount for non-cash gifts to our church employees

As a church, are we supposed to report a non-cash gift ($1400 hotel stay) for one of our employees, as reportable compensation to the employee? Or does …

Retreat monies

The marriage leader from our church decided to pay in advance a deposit to the main speakers for our marriage retreat.

He also paid the deposit at …

Love Offerings

If a church decides to give a non member a love gift of 10,000.00 and no service was performed

does the church have to send a 1099 to IRS?

Love offering and 1099

I was doing an internship at my church, and at the end of the internship, a member of the church gave a love offering to the pastor, his wife, one other …

Love offerings for Individuals

Our church took up 3 love offerings during the year. One for our pastor who was retiring, one for a member who was moving away and a Christmas love offering …

Collection for seminarian assistance?

We want to take up a collection to help seminary students in our church. It wouldn't be donations by person specific but would be distributed by the deacons …

pastor aide ministries & IRS

Are contributions to Pastor's Aide Ministries reportable to IRS as income to the pastor, if this account is used exclusively for his needs?

One time financial gift of money and a car to Pastor and his wife. How do we report these gifts?

We are a small group of 25. We have paid our Pastor whatever we could over the last 7 years and always less than $26,000 a year and reported it on a 1099 …

Examples of Nontaxable Love Offerings

What love offering is not considered taxable and still be considers a deductible contribution to the contributor? Can someone give some examples?

1099 & Pastor

If the pastor received a large donation from the church which box on the 1099 would that be reported on.

The pastor receives wages, love offering, and …

Biblical Counseling

I am a Biblical Counselor(BA in Christian Counseling/Theology) and I want to counsel (payments are by donations only)under the umbrella of my church (I …

"Gift" from a Church Member to a Church Employee

Church member gifted a church employee $10,000. Check was made payable to the church. Is this a tax deduction for the member? and is the employee who …

Funeral Honorarium given to clergy

I work at my family owned Funeral Home in Illinois. When we have a funeral it is customary for us to give the clergy who is doing the service a check for …

Benevolence Fund

When is a donation from a benevolence fund taxable to the individual recipient?

Monetary gift to former pastor who moved away 30 years ago

If we give a financial gift (over $600) to a former pastor of our church who moved away 30 years ago, are we required to give a 1099 to him and file with …

Music Minister

We have a new person in our music ministry. He is a volunteer, being that our church cannot afford to pay him. Our Pastor has suggested we (members)give …

widow's stipend

Our church pays a stipend to the wife of our deceased pastor. If members provided love gifts to her is that considered taxable income and a charitable …

gift to unpaid pastor

Our church is a free church and as such is not registered as a 501(c)(3) although we meet the qualifications and our members are allowed to take a deduction …

Using Pastors Love offering to offset expenses

Can you use the funds collected for the Pastor's Love offering towards any expenses occurred leading up to Pastor's Appreciation Anniversary? Also can …

Pastoral Love Offering to reduce debt on mortgage

Is it legal for SOLICITED church members (not the entire congregation) to write a check to the church, then to have the church turn around and write a …

Disneyland Trip paid for by the Church

Our church has a Bible memorization of the book of John for the sunday school students. If the student can memorize the entire book without error then …

How to give someone small compensation for cleaning church?

We have a very small church congregation and we rent a storefront as our meeting place. Our pastor has a secular job from which he draws his income. We …

Do I pay taxes on love offering given for volunteering to teach?

I will be working for a school that is a ministry of a church. Well, make that volunteering because it is a non profit volunteer position. I will be …

Love offering for a church member

Does the Church have to send a 1099 statement to a church member that has received a one time Love Offering from the Church for extraordinary service helping …

Monetary Gift given to self employed ordained pastor to be used to puchase ministry tool

I'm an ordained minister--self employed by irs standards.

I have someone who wants to buy me something. I will use it for ministry purposes.

If he writes …

Pastor's Gift

Can the Pastor Aide sell tickets to the Pastor Anniversary Luncheon and then give all the money from the tickets to the Pastor as a gift? Is it legal? …

Love gift for Board Member

Our church wants to provide a love gift to a board member, who has put in a lot of volunteer time overseeing a remodel project in the church sanctuary. …

Pastor's aide ministry

Is a pastor's aide ministry illegal according to I R S rules & regulations?

Question regarding a volunteer worship leader

Our church had a musician from the congregation lead worship on Sundays for several years, he was completely volunteer and was not considered to be on …

Love offering to a member...

Our church took an offering for one of our members and it was a significant amount. Is the member receiving the offering required to pay taxes? Secondly, …

Payroll taxes (Social Security, Medicare) on love gifts to pastor.

If a church receives a (tax deductible) love gift for the pastor who is an employee of the church, does the gift create a tax liability to the church for …

singers and love offerings

Our church has a few gospel groups that sing at church throughout the year. We take up an offering from the congregation and give it to the singers. The …

Love Offerings for someone not providing services

What about love offerings for someone in the community that had a house fire or a catastrophic medical emergency?

Giving Gifts to Non-Employees

Our small start-up church decided to be served by two part-time pastors whose only responsibility is to preach on Sundays. They set their own schedule …

WHAT BOX DOES THE LOVE OFFERING GO IN ON W-2

WHAT BOX DOES THE LOVE OFFERING GO IN ON W-2

Supplementing a love offering

Every year our church takes up a love offering as a Christmas gift for the pastor. In the past, this offering has reached a certain amount and so for …

Gift of money to church member - taxable income?

If a church member is sent a check for $1,000.00 to help out with expenses - is it taxable income to the church member? The Church member did a large …

Retirement offering for a non-employee

We are going to be taking a retirement offering for a ministry leader who is volunteer, not an employee. Letters are going out to congregants ahead of …

Reporting of Cash Gifts to Non-Employees

I have seen and read many articles concerning the giving of cash or cash equivalent gifts to Pastors and other employees.

However, I have never seen …

Not Tax Deductible for the Donor either...

Readers should also be reminded this time of year to see your other Topic on 'Love Offerings or Donation'. Because the gifts are directed to an Individual …

Rental Donation - tax Deductable?

If someone offers the pastor a housing rental at a discounted rate is there a way to offer a tax deduction for the balance?

In other words, the church …

A day of offering for Pastor without being considered income

I have heard where one day a year, the church can have members give a check made out to the pastor, and the pastor can receive the funds without being …

Love offering for retiring Music Director-tax deductible for donor?

Our Music Director is retiring and we are collecting a love offering from the members written to the church, designated for his love offering. We are issuing …

Love Offering received from non-church member for a staff member

My church has been receiving a love offering for a Pastor on staff from a non-church member just to help the staff member, kind of like supporting a missionary. …

Purse offering for retiring priest

I am confused. Our priest is retiring. We plan on collecting a purse for him. We will tell the congregation that their contributions are not tax deductible. …

Pastor Love Offerings.....Taxable Or Not

The church will have a special service to celebrate the Pastor's 4th Anniversary. During this service a love offering will be taken up for the Pastor. …

Are Benevolence Gifts taxable to the receipient?

Our church has a benevolence fund. A non-church member wants to donate an amount for a specific church member in need.

1) Is the recipient liable to …

Love Offering or Donation

There is a member of my church who gives to our pastor each week. Should she be using "love offering" or "donation" to Pastor in order for her to claim …

handling love offerings for pastors

How should you handle a love offering picked up for your pastor. Should you give it to him then and there, or should you bring the money in the church …

love offering for the piano player

We have recently had a retired woman join our congregation. She used to play the piano at a church that she used to attend. She has begun to play the piano …

Love offering for visiting singing group

If a singing group that travels and performs gospel music is randomly given unsolicited love/freewill offerings from various people in attendance, is this …

How to file taxes as a bi-vocational missionary on deputation

I am a missionary on deputation this last year raising support. We were in a dozen or so churches and every church gave us a love offering/honorarium in …

Are love offering given by a congregation taxable to an individual and a deductible contribution to the members?

An employee's husband committed suicide and the church took up a love offering at the next church service. Checks were made out to the church,which deposited …

Pastors vehicle

The church is paying car note for pastor, is it recorded on a 1099?

Designated Benevolence Gifts to church members.

If someone writes a check to the church and designated it as a benevolence gift to a church member, should he received credit for this gift on his contribution …

Love offering for missionary

We wanto give our missionaries gifts and money for Chritmas. How do we do it?

$1000 paid to song leader

We paid $1000 "bonus" at year end to a member of our church that leads the music almost every Sunday on a volunteer basis. Would this need to be treated …

Pastor love offerings

Can love offering to a pastor be placed in another account in the church's name (pastoral account) for the pastor to use at will with debit card?

anniversary gift

Is it legal to give a pastor $12,000 from the church general funds?

Love gift for Pastor's Wife

Our church wants to take a love offering for our pastor's wife for her birthday. She is considered a staff member but is not paid. How would we handle …

TAX DEDUCTIBLE

I play the organ at church and am not paid for this. Can I claim a tax deductible for a certain amount if the secretary gives me a slip stating as a donation …

a church member giving

A church member gives a monetary gift to a pastor to them personally, can the church give that church member 'credit' for it to be tax deductable?

just a comment

Why does the irs have the right to control what we would understand to be a blessing from GOD.when a person receives a love gift or love offering where …

Required giving

If the pastor determines his pay and mandates that each member pay a specified amount,and has checks made out to him, is this correct and deductible? Birthday, …

how do you handle love offerings made out to the pastor

what if the love offering/anniversary checks are made directly to the pastor?

Question on donating a house

We are thinking about donating the use of our home to a Christian Counseling Center (501c3). One of the counselors (who is paid far less than other counselors …

love offerings to church employee, not the minister, who pays the employer part of FICA & medicare taxes?

When a love offering is taken up for a church employee, not the minister, who pays the employer part of FICA & Medicare taxes?

Gifts and social secuity tax

Here is the scenero: A person who used to be an active member and some of his family were deacons of church A . The person left the church A 3 years …

Guidelines for taking an income from personal ministry

Hello,

I am in the process of starting a personal ministry and I'm wondering what the guidelines are for taking an income from donations received. …

timing of social security allowance

Ok, please bear with me as I'm really not too bright about all this tax stuff, but here goes.....our church has always given us an allowance (just one …

Gift to traveling Pastor

If our church has a Pastor who is not of our church stop on his way through town, we give that person about $100 for travel expenses. They did not come …

SHOULD WE BE PAYING THE ELDERS IN OUR CHURCH?

The Elder of our church we give him $500 a month from our Gas checks that comes in. We write him a check out of the General Fund. Is this legal and should …

Love Offering

Does a church group have to collect w-9 info & prepare 1099 forms for recepients of love gifts or is the fellowship group exempt from these IRS stipulations …

Gift to a church member?

I was asked to do some help around the church and the pastor wanted to pay me.

I am retired and did not want to mess that up.

Can I volunteer …

IRS Reporting question

I have just started the financial reporting at a church. The pastor receives a salary and housing allowance that is reported on the W-2. Taxes are reported …

HOW CAN YOU GIVE A MINISTER A PERSONAL LOAN

WHAT SUBSTANTIATES A CASH GIFT AND WHAT IS THE LARGEST AMOUNT GIVEN.

vickey's reply

See this post and its comments.

Gift to church members and employees

The church wrote checks to their church members who volunteers to help the church during the year about $1,000 each and $1,000 to their employee.

…

Love Offering or Guest Minister Honoriaum

When a church has a visiting pastor or evangelist preach and an offering is taking up, is that recorded in the books as a "love offering" or "guest minister's …

Love Offerings for Ministers in Pastor's Absence

Can I as a pastor issue my ministers who minister in my absence a love offering?

Answer

Yes you can; however, it will be taxable income for …

If pastor receives designated contributions thru payroll is it tax deductible to the donor?

We have a pastor who has officially resigned and moved. Some of the congregation has pledged to donate money weekly through the end of 12/31/10 as part …

Do I Have to Pay Tax on a Cash Gift?

To honor my 25 years working at church as a secretary, the congregation secretly took up a collection to be used to pay for a trip overseas with the pastor …

Regular Love Offerings Taxable ?

We are an independent reformed church, our clergy do not receive a paycheck of any kind, they work for the love of God. However, by general consensus we …

Monetary gift to pastor

Our church made a significant profit on sale of asset and wants to give a portion of the proceeds as a gift to our pastor to help him with his financial …

Is Benevolent Offering to the members taxable to them?

My church gives $200 in a monthly basis to needed members. Do I as the treasurer ask the member to file a W-9 so that at the end of the year I issue that …

Love Offering and Taxes

If a love offering is given to our Pastor from our church account.... how can we report this as non-taxable gift or can we? Should our Pastor have to …

Love offering

Can a church proclaim a love offering as long as church supported?

Answer

You can take up and give love offerings any time you wish...just …

Guest Speaker Love Offering

Giving a love offering to a guest speaker from India. The church members make their checks out to our church for the deduction, but we as the church are …

Love Offering/Taxable?

If people want to donate to the Pastor, should the checks be written to the Church and then the Church write a check to the Pastor?

Gift to Church Member

If a church gives a gift (one-time) to a member of the church for need based purposes, is that taxable? If the member is a deacon or another type of leader …

What is sent to IRS when Pastors only receive love gifts

Question regarding 1099 and love gifts:

After reading through several links on your website, I am understanding that our church needs to give our pastor …

Are Gift Cards Taxable?

We do not have an ordained minister but a member of the congregation that preaches the sermons every week and we feel he serves as our pastor. He does …

LOVE OFFERING FOR PASTOR

WE HAVE A PASTOR THAT IS ON SS DISABILITY HE ONLY PASTORS ON SUNDAY AND CAN NOT GO VISITING DOOR TO DOOR DUE TO HIS DISABILITY - CAN WE PAY HIM A LOVE …

Love Offering Question

Are love offerings taxable?

Answer

Usually. See this page for love offering guidelines .

Vickey

Pastoral Gifts

Once a month our ministry has a set date to give our pastor a monetary gift. If the amount is not a certain number, an additional check is written out …

Funds Received From Anniversary

I'm not sure how to handle the funds received in our Pastor's Anniversary. Our pastor does not receive a salary and so the monies received during the Anniversary …

Guest Speaker Receiving Love Offerings Only

Question regarding guest speakers and love offerings:

I am Treasurer of our Church. Our Board has agreed that this year Guest Speakers would be paid …

Are Love Offerings Taxed?

Is a minister required to pay SE tax on love offerings?

vickey's reply

Yes. Most love offerings are considered taxable to ministers, so …

Pastor Pay Label on Church Financial Report

Question regarding pastor's pay:

First and foremost I would like to thank you for your website and all the great information and updates you send out. …

Speaker Fees, Love Offerings

When we have a speaker come and pay him a "fee," plus give him a love offering (for which the church members expect a tax-donation) - are we supposed to …

Love Offering For Visiting Songwriter

Question regarding a love offering for a visiting songwriter:

We are having a concert in which a songwriter (not an employee, or having any affiliation …

Monthly Love Offering

Is it legal for a pastor to receive a monthly love offering and a salary?

Vickey's Reply

It's perfectly legal. It is also most probably taxable …

Pastor's Love Offerings and Reimbursements

I have two questions regarding love offerings for our pastor and reimbursements.

1. I just read your answer about love gifts for pastors/individuals. …

Processing Love Offerings

We've had a question arise concerning love offerings. I understand the basic rationale for the offering being non-deductible for the giver, but also not …

The comments above are for general information purposes only and do not constitute legal or other professional advice on any subject matter. See full disclaimer.