Accounting for Churches and Nonprofits

Accounting for churches and nonprofits is a whole different ballgame than commercial accounting!

Been asked to do the accounting for your church or nonprofit and have no idea where to start?

This site was built for you!

See links below for pages on bookkeeping tips, fund accounting, setting up a petty cash account, understanding financial statements for nonprofits, etc.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Learn Accounting for Churches and Nonprofits:

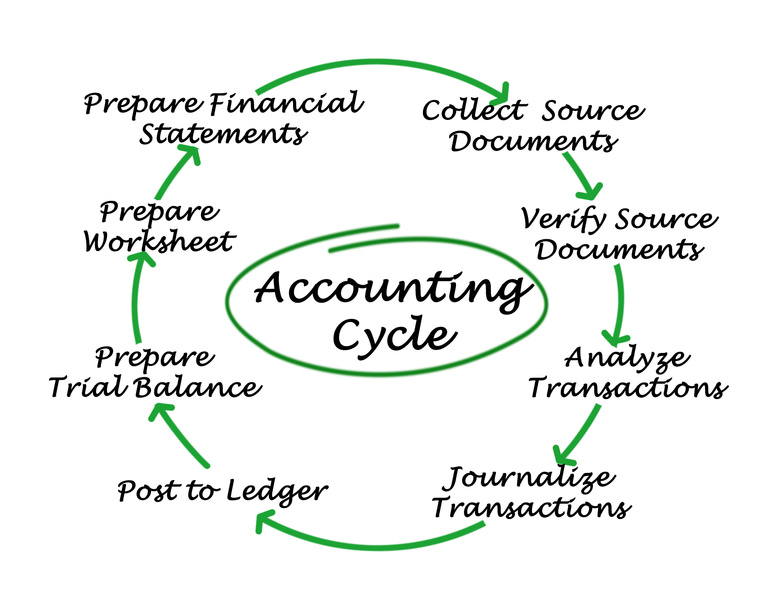

Accounting is define as a system of recording and summarizing financial (business) transactions in such a way that they can later be analyzed or used to communicate with others.

However, all accounting is not created equally!

Where commercial accounting’s main focus is on measuring profit or loss…fund accounting (used primarily by churches and nonprofits) focuses more on measuring the incoming and outgoing funds to aid in the ethical and legal responsibilities of the nonprofit.

Learn basic accounting concepts that will help you with that measuring on the basic accounting for churches and nonprofits page listed below.

In the mid 1990’s, the Financial Accounting Standards Board (FASB) issued the Statement of Financial Accounting Standards (SFAS) Numbers 95, 116, 117, and 124. They describe the way nonprofits should account for contributions, present their financial statements, and account for certain investments.

The emphasis of the SFAS financial statement reporting is now on “net assets” classification. Learn the three main categories of net assets on the fund accounting page (link below).

Learn more...

Knowledge of some basic accounting concepts and bookkeeping systems is necessary in order to set up and maintain an accounting system.

Learn the difference between two bookkeeping systems and basic accounting for churches and nonprofits...

Fund accounting is an accounting method that groups assets and liabilities according to the specific purpose for which they are to be used.

It keeps restricted and unrestricted funds separate for churches and nonprofits. See this page for more details...

Managing bookkeeping for churches can present unique challenges. Apart from standard accounting procedures, there is the additional task of managing restricted funds alongside the overall financial records.

You might be facing a chart of accounts overloaded with numerous unnecessary accounts from past volunteers. On top of that, you've come across errors in your payroll entries. These ebooks on church bookkeeping are specifically designed to assist you in handling these issues effectively.

Even though each organization's chart of accounts is unique, most nonprofit and churches use a universal numbering system to avoid confusion for your staff, bookkeepers, accountants, and financial institutions.

See tips on building an effective chart of accounts...

I have worked with many churches throughout the years and seen quite a few bookkeeping and accounting errors. Most are unintentional and some are harmless, but some of those bookkeeping errors were devastating to the church.

See five common bookkeeping errors below...

Gifts in-kind are donations of items, use of property, and professional services. Accounting for those non cash donations can oftentimes be confusing.

See how to acknowledge and account for those donated goods and services...

The greatest advantage of having a benevolence fund program properly set up is to ensure donations to that plan will be considered tax-deductible and comply with IRS regulations...

Bookkeeper errors can give you inaccurate data and end up costing your church or nonprofit organization thousands of dollars to "clean up". See tips to spot those errors and correct them...

A “fund” in church fund accounting is a unique designation of money that is tracked separately that everything else, but is still a part of your larger total. See what pitfalls to watch for in fund accounting...

A fund accounting system is simply a system of collecting and processing financial information about your church or nonprofit.

Setting up an effective accounting system is one of the most important things you can do for your organization. See tips on setting up the best accounting system for your organization...

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

The greatest advantage of having a benevolence fund program properly set up is to ensure contributions to that plan will be considered tax-deductible and comply with IRS regulations...

Choosing nonprofit or church accounting software for your organization can be a stressful and tedious chore!

You are not looking for the best accounting software on the market. Instead...you are looking for the church fund accounting software that best fits the needs of your particular church...

If your church is embarking on the process of shopping for a new church accounting software, there are a few tips to keep in mind to make it a smart choice. See tips on setting up that new accounting software as well...

Before you generate your financial statements, there is a process you should go through to ensure the accounting reports you give your pastor, treasurer, or governing council is accurate and complete...

A Petty Cash account is easy to set up and will save you from writing a lot of small checks or using your personal funds that you have to be reimbursed for later. First step is...

Nonprofit and church staff and volunteers from all over the world can help each other out with tips, ideas, comments, and questions on this page...

Definitions to help you better understand the accounting terms used on this site.