Financial Statements Preparation Checklist

Before creating your financial statements, it's important to follow a process that guarantees the accounting reports you provide to your pastor, treasurer, or governing council are both accurate and comprehensive.

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

For more details on reconciling your bank and credit cards and generating financial statements, purchase the Church Accounting How To Guide.

There is a Month-End Checklist in the book that you can copy and check off the to-dos each month.

Before preparing financial statements, review the following checklist:

1. Start by gathering all relevant financial documentation, such as receipts, invoices, and bank statements, to ensure that every transaction is accounted for. Next, organize these documents chronologically or by category to make the process more efficient.

2. Once your documents are in order, record each transaction in your accounting system, whether it's a manual ledger or accounting software. Be meticulous in capturing details such as dates, amounts, and descriptions to avoid any discrepancies later on.

4. Check unopened mail for any checks or donations.

5. Look for any unpaid bills.

6. Verify that all contributions have been deposited into the bank and recorded in your financial records.

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

8. Ensure that all paid bills are recorded in the appropriate expense accounts and processed through your checking account.

9. Confirm that your payroll is documented in your financial records.

10. Make sure all payroll liabilities are paid to the correct agencies.

11. Record credit card charges to their respective expense accounts.

12. Review your bank statement and log interest earned, bank charges, and any automatic withdrawals into the appropriate accounts in your financial records.

13. Document any online donation deposits in your accounting records.

14. Once all transactions are recorded, reconcile all Balance Sheet accounts such as bank and credit card accounts. Follow the steps below to complete this crucial task before generating your monthly financial statements.

Managing bookkeeping for churches can present unique challenges. Apart from standard accounting procedures, there is the additional task of managing restricted funds alongside the overall financial records.

You might be facing a chart of accounts overloaded with numerous unnecessary accounts from past volunteers. On top of that, you've come across errors in your payroll entries. These ebooks on church bookkeeping are specifically designed to assist you in handling these issues effectively.

Description page for the ebooks and bonuses included in the Bookkeeping for Churches Package

Bank Reconciliation First then Financial Statements

Reconcile your accounts regularly, comparing your records against bank statements to identify any errors or omissions. This step is crucial for maintaining accuracy and building trust with those reviewing the financial statements.

Here are the steps to follow for bank reconciliation:

- Review the bank statement and ensure that every charge has been accurately recorded in your general ledger account. If you're uncertain about a charge, contact the bank without delay.

- Examine the deposits that have cleared and compare them to those recorded in your general ledger account. Be aware that the last deposits of the month may not yet appear in the bank; these are referred to as outstanding deposits. If it seems to be a timing issue, it usually isn't problematic. However, if your accounting records indicate that a deposit was made earlier in the month and it’s not reflected by the bank, further research will be necessary.

Reasons why a deposit may be missing from your bank statement or differ from your accounting records:

- Bank Error: Although rare, banks can make mistakes. It's important to address any discrepancies promptly!

- Incorrect Recording: This is a common issue I've encountered. Often, it happens when a donation is overlooked or loose cash isn't accounted for, resulting in mismatched deposit amounts.

- Not Deposited: Sometimes, funds may still be stored at the church or left in someone's car, forgotten by the person responsible for making the deposits.

Additionally, there may be deposits reflected in the bank statement that aren't included in your accounting records.

The most frequent example of this is online donations.

With online donations, your payment processor might automatically transfer funds into your checking account. If this happens, ensure you log into your online donation processing software to record those donation "batches" or "payouts," and restart your bank reconciliation. Remember to open each "batch" to review the fund assignments and assign them correctly in your accounting software.

I prefer to record the "gross" donation amount in my accounting software and list the "processing fees" as a negative amount (assigned to the appropriate expense account), ensuring that your "net" amount aligns with your actual bank deposit, especially if your online donation processor deducts fees before making deposits.

Next, compare each check you’ve written against those that have cleared your bank. List any checks not on the bank statement as outstanding checks. For any checks appearing on the bank statement but missing from your accounting records, investigate further. Were they approved and signed by an authorized individual? If so, determine why they weren’t recorded.

Once you have identified the outstanding deposits and checks, you will be ready to finalize the reconciliation and begin generating your financial statements.

Donation Guidelines Package

A set of 4 ebook packages that covers many of the following topics...

- How to handle and receipt stock donations

- How to handle free rent and labor donations

- How to handle non-cash contributions

- What to do if you receive a DAF (donor advised fund) contribution or grant

- How to handle Quid Pro Quo donations and other fundraising income such as drawings and raffles

- Donation policies and procedures

- Much more - Click here for details

Bank Reconciliation Steps

The majority of accounting software is designed to streamline your monthly reconciliations for a hassle-free experience. Check your software’s instructions or reach out to their support team to learn how to reconcile your accounts. (Refer to the section below for guidance on reconciling QBO.)

If you have to do it by hand...

- Set up a spreadsheet and input the ending balance from the bank statement. There is one in the Spreadsheet Package.

- Add the outstanding deposits to this balance.

- Subtract any outstanding checks.

Spreadsheet Package

This spreadsheet package is designed for churches and nonprofits.

It includes:

- Contribution Tracker;

- Automatic Accounting (tracks income and expenses for up to 5 funds);

- Bank Reconciliation (reconciles accounting workbook to your bank statements);

- Collection Count sheet;

- Mileage log;

- Travel reimbursement

- Customizable Word doc with a Cash, Noncash, and a Quid Pro Quo Contribution Receipts.

The ultimate goal is to achieve a balanced cash account in your accounting records.

If the amounts do not match, you will need to review all entries in the general ledger and compare them with the bank records.

A common mistake is a transposition error. For instance, if a check was issued for $78 but recorded as $87, this is a transposition. If the discrepancy is divisible by nine, it likely indicates a transposition error. Carefully compare each check and deposit listed on the bank statement to identify the error.

If there are outstanding checks from the previous month that have not cleared, your reconciliation will be off balance. Check the prior reconciliation to ensure that all outstanding checks have cleared this month. If any remain uncleared, add them to the outstanding checks list.

Now that your bank and accounting records are reconciled, there are still a few steps to complete...

Examine the reconciled items for any outdated or unusual entries. It’s not uncommon for checks written toward the end of the month to still be outstanding, but if you notice checks that should have cleared by now, investigate the reason. Reach out to the person or company involved, as the check may have been misplaced or lost.

QuickBooks Online® for Churches and Not-for-Profit Organizations

This book contains hundreds of screenshots that helps you set up and use QuickBooks Online (QBO) effectively.

Topics include:

- Procedures to guard against theft and errors

- Designing a chart of accounts (with examples for different types of nonprofits in the appendix)

- Converting a desktop QuickBooks organization into QBO

- Tracking donor gifts and grants

- Importing donor and vendor contact information

- Receiving money, paying bills, and tracking credit card charges

- Reconciling accounts

- Budgeting

- Designing management reports

- Month-end and Year-end procedures

- Tracking fundraisers, in-kind donations, volunteer hours

- Manage member dues, fundraisers, and trips

- Allocate overhead to programs & grants

- Sample charts of accounts for associations, PTAs, private schools, scouting troops, and civic groups

- And so much more!

QuickBooks Bank Reconciliations

Bank reconciliations in accounting software are generally much simpler than reconciling with spreadsheets.

In both QuickBooks Online (QBO) and QuickBooks Desktop, the process is quite straightforward.

There are numerous YouTube videos and articles available that guide you through reconciling your accounts in these QuickBooks products. Here’s a brief tutorial on reconciling QBO, which I frequently use for my clients. If you require more detailed instructions, feel free to search online!

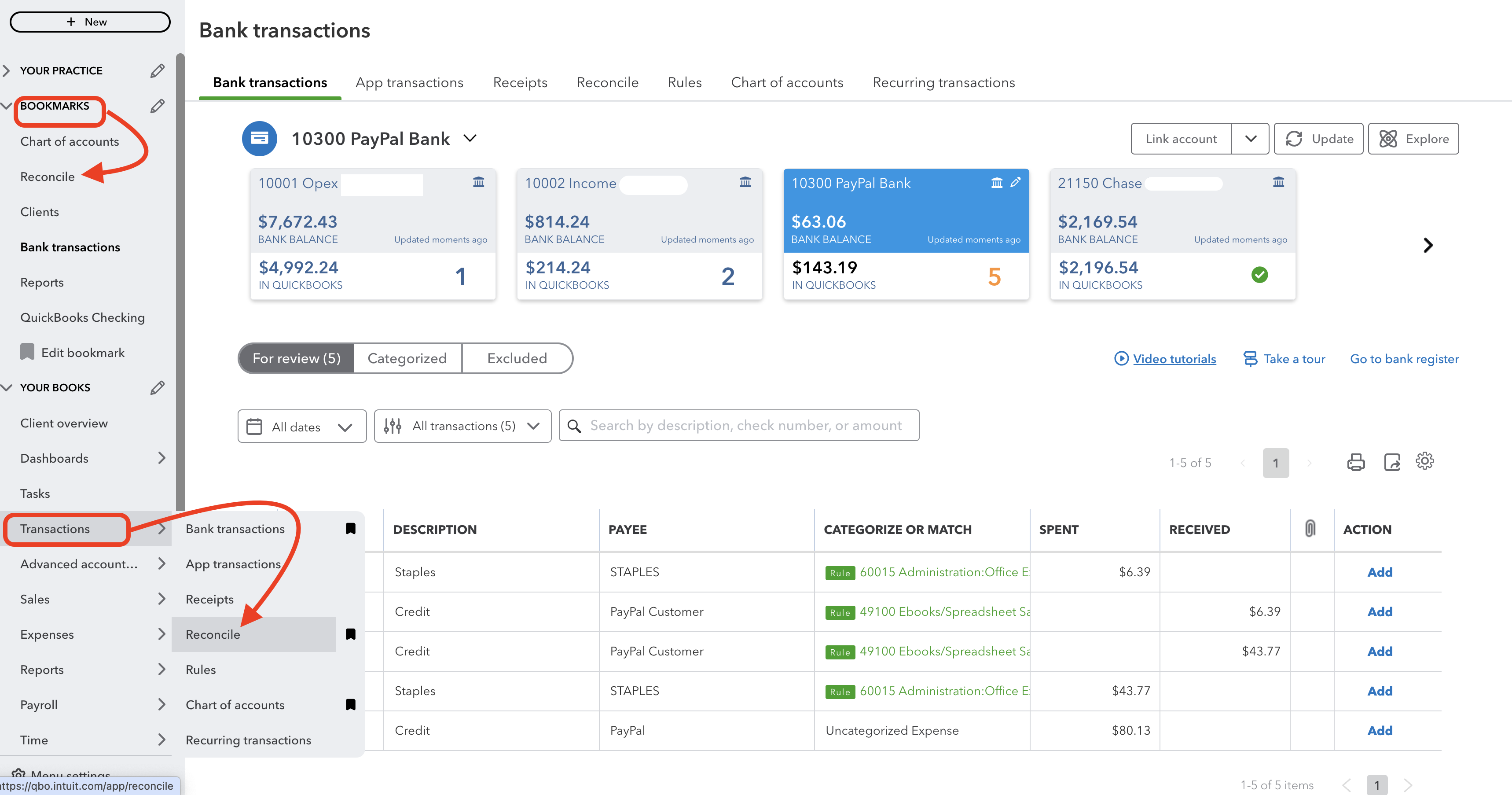

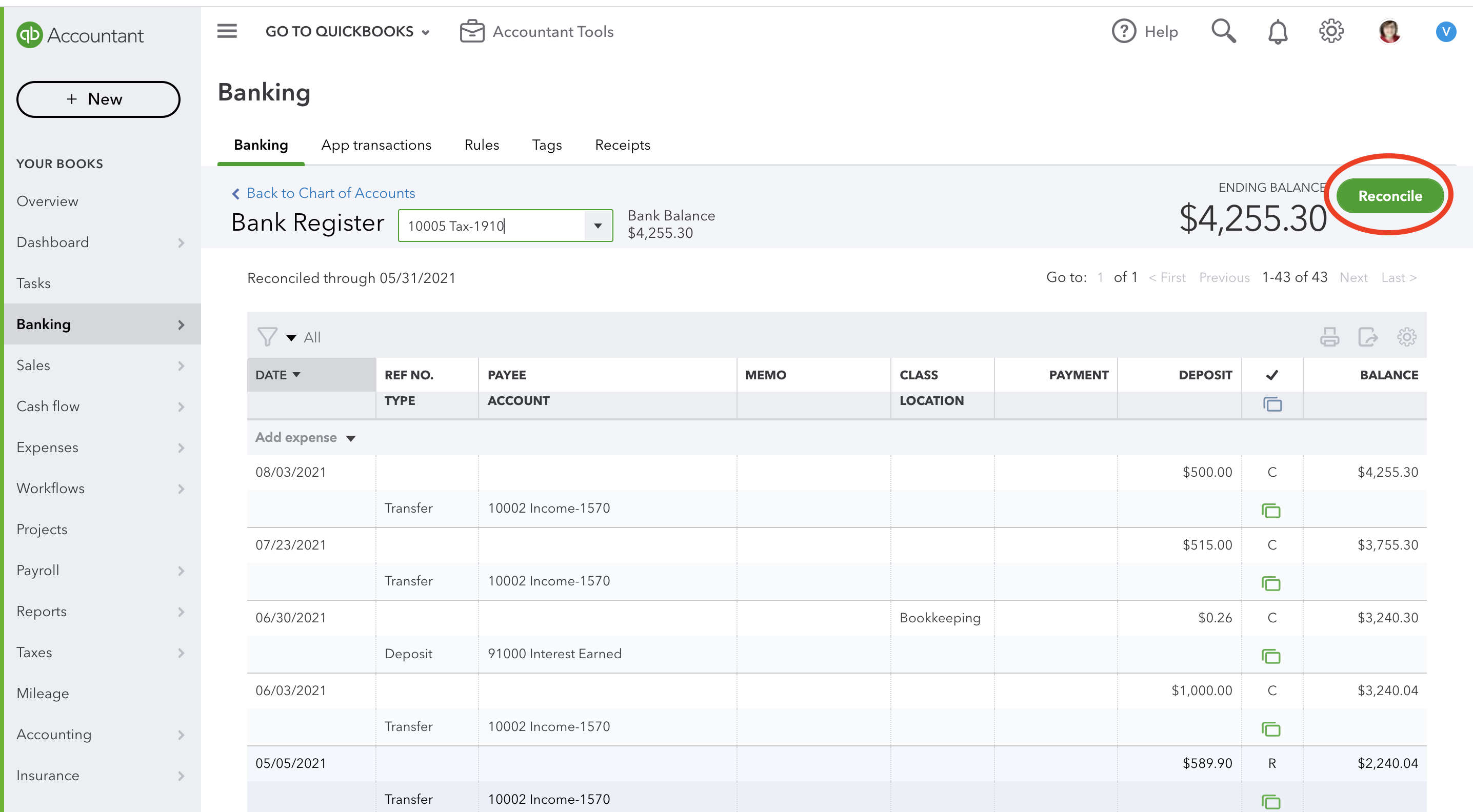

To begin in QBO, navigate to the left column and select "Transactions," then click on "Reconcile" in the pop-up window...or just "bookmark" it and it will appear at the top of your Navigation column.

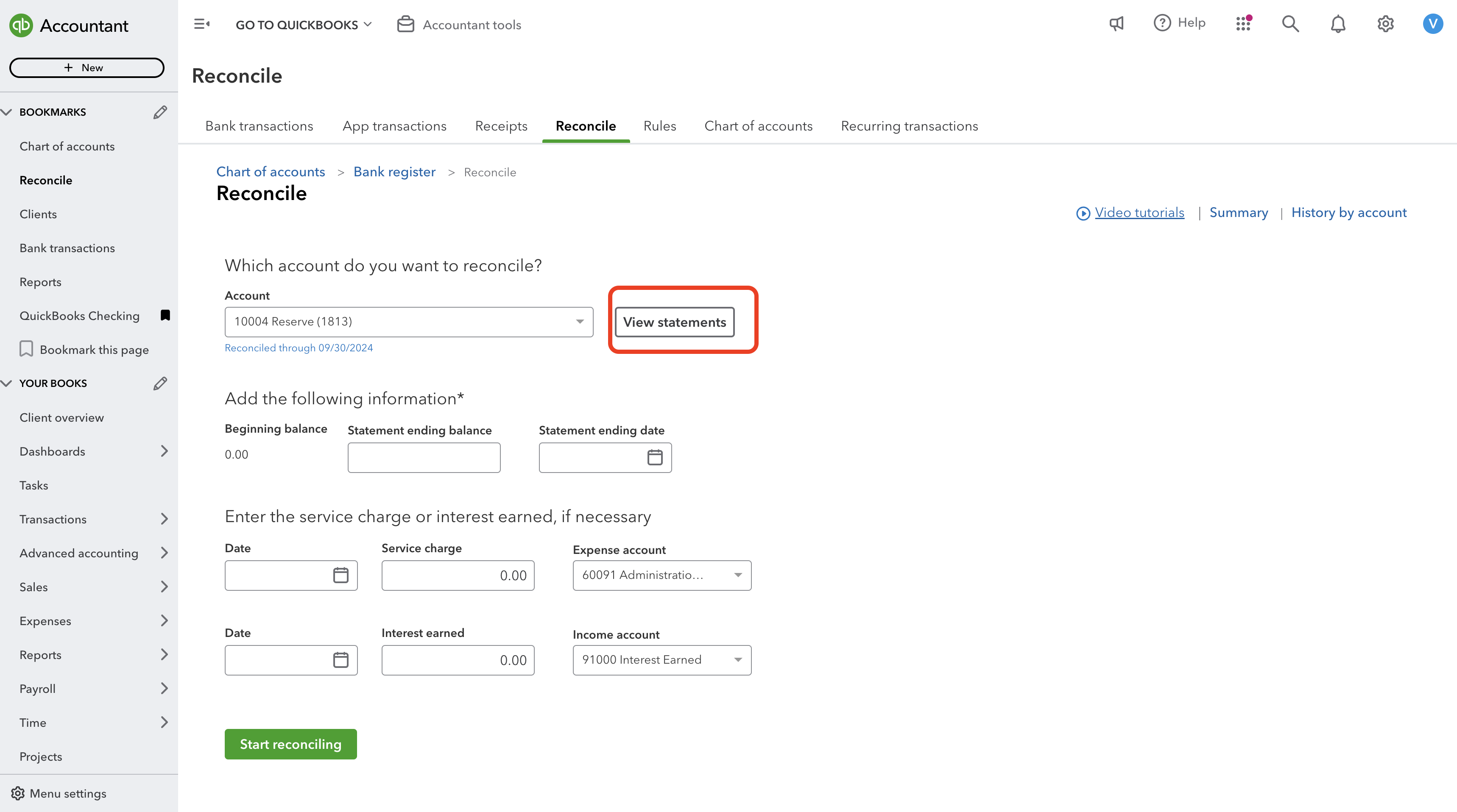

Enter your ending balance and closing date. Most of the time, it involves simply clicking on all the deposits and payments that appear on your bank statement. QBO currently automates the selection of all transactions that have cleared your bank within the specified timeframe, so you won’t have to manually check off each deposit and expense unless the amounts don’t balance out. However, I strongly recommend ensuring that each check number aligns with the bank statement before completing the reconciliation.

It’s also crucial to carefully review each transaction in the bank reconciliation window. Confirm that each one appears to be an "ordinary and necessary" expense for your organization. If anything seems unusual, take the time to investigate!

Tip: Keep a copy of the Reconcile Report filed alongside your bank statement.

Another helpful tip is that you can now view bank statements within QBO for certain banks and credit cards! If you see a "View Statements" button in the reconciliation tab, as shown in the image above, click it to download your bank and credit card statements.

There are multiple ways to access the reconciliation window in QBO, but I prefer using the left navigation column. If I’m already in the register I want to reconcile, it’s easier to click on the green "Reconcile" button located in the top right corner.

The Policies and Procedures Package includes an ebook on Receipts and Reimbursements that explores the management of receipts and supporting documents.

Additionally, it provides insights on establishing and managing an efficient accountable reimbursement policy.

Includes a sample of a resolution you can use to present to the board to set up and approve an accountable reimbursement plan.

.

This ebook is included in the Policies and Procedures Package. However, you can purchase it by itself for only $7.95 by clicking the ADD TO CART button below!

The Receipts and Reimbursements ebook is also part of a larger "Policies and Procedures" Package" that is packed full of valuable information and for a limited time you can purchase all 5 ebooks and 8 policy templates for only $32.80

Final Financial Statements Preparation

15. Finally, draft the financial statements, including the balance sheet, income statement, and cash flow statement. These reports should provide a clear picture of the organization's financial health, enabling informed decision-making by your pastor, treasurer, or governing council.

16. Review the statements for any errors or inconsistencies, and seek feedback from a knowledgeable colleague or professional if necessary. By following this systematic approach, you can ensure that your financial statements are both reliable and insightful, fostering transparency and accountability within your organization.

Resource:

Church Accounting, The How to Guide for Small & Growing Churches by Lisa London and Vickey Boatright Richardson