How to Properly Manage Payroll

One of the biggest challenges facing small churches and nonprofits today is how to properly manage payroll for their organization. I have grown increasingly alarmed over some of payroll issues I have been seeing lately.

Some financial administrators innocently believed because their church is exempt from taxes that they are also exempt from withholding and remitting payroll taxes.

They are partly right.

You should not withhold and match FICA (Social Security and Medicare) taxes from a qualifying minister’s pay. See more on clergy taxes.

However, unless your church have filed an IRS Form 8274 and been approved (very few churches qualify for this exemption), your church is not exempt from withholding FICA taxes from their non-minister employees’ wages and remitting them to the IRS along with the church’s share of the tax.

I was discussing my concerns with Bill O’Connell, CPA and founder of the accounting firm, Wisdom Over Wealth, and he stated he was facing a similar situation. He mentioned that many Pastors and Treasurers (paid and volunteer) do not often realize that they can be held personally responsible for the penalties incurred from these payroll mistakes.

I asked him if he could elaborate for my readers and this was his reply:

Treasurers and Pastors can be personally liable for payroll taxes.

The Church Accounting: How To Guide devotes a whole section of the book to payroll for churches. It covers payroll terminology and forms and then takes you through the steps necessary to set up a payroll, calculate and file the necessary taxes and forms, and even details how to handle the minister's payroll. It also includes sections on filling out IRS forms: 1099-Misc, 1099-NEC, and 1096.

If you have QuickBooks or are considering using it in the future, go ahead and purchase the QuickBooks for Churches and the How To Guide combo for a complete package on setting up and administering a payroll using QuickBooks.

Another confirmation for me that this issue on managing payroll tax issues was a subject that needed addressed with my readers was in an article I read in Church Finance. Dan Busby wrote a very informative article regarding church payroll tax audit.

He stated in this article that even though the IRS has not been auditing churches since 2009, church payroll tax audits are on the rise as they are generally simpler to schedule and conduct.

The Bible says in 2Timothy 2:15 (KJV) "Study to shew thyself approved unto God, a workman that needeth not to be ashamed, rightly dividing the word of truth."

I know this is speaking of the Bible, but God put you in your current position in His kingdom. Does it not behoove us to study the law of the land as well and be His workman that needeth not be ashamed?

So for the rest of this rather lengthy article, I will be writing to you as if I am sitting across the table or desk from you and discussing some points of concern I see all the time regarding managing payrolls:

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

Manage Payroll: Classification of Workers

The American Institute of Professional Bookkeepers has stated that one area you will definitely begin to see more scrutiny by the IRS is the misclassification of workers.

Read this article on: Misclassification of Workers

Dan Busby, stated in his book Church and Nonprofit Tax Guide:

“Seasonal workers and those working less than full time such as secretaries, custodians, and musicians require special attention for classification purpose. If a worker receives pay at an hourly rate, it will be difficult to justify independent contractor status. The conclusion holds true even if the workers are part-time.”

Elaine Sommerville takes it even further in her book: Church Compensation:

"Few areas of compensation and payroll receive as much attention from the IRS as worker classification." She dives in even deeper and states that in some instances paying volunteers can involuntarily classify them as employees and make those payments subject to FICA withholding and matching.

Regarding ministers: If you are pastoring a local church, you should generally be classified as an employee of that church and receiving a W2 form. Read more in this article: Is Your Minister an Employee or Self-Employed?

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

Manage Payroll: Get Professional Help

Because of the ever-changing labor laws and complex state laws, I

usually advise churches and nonprofits to use payroll services familiar

with nonprofits.

However, if you’re a small church and only paying your qualified minister, a simple housing allowance. There is no need to pay a payroll service to simply process housing allowance payments.

Please allow me to veer slightly off subject here and jump on my soapbox.

Many churches do not realize the tax benefit a housing allowance can be to their minister and that many ministers being paid a very small amount...could actually receive a 100% of their compensation as a housing allowance!

Bill O’Connell, Wisdom Over Wealth, stated it best with these words, “Most bi-vocational (or poorly paid) clergy should not be receiving salary – only housing allowance. Thus some churches may be able to stop running payroll all together – at least until they pay more than the pastors housing allowance.”

While I’m still up here on my soapbox I might as well add another advisement. Pastors should be requesting voluntary federal and state withholding income taxes to avoid quarterly estimated payments. HOWEVER....do not withhold taxes form the nontaxable housing allowance payments!

Ok…climbing off my soapbox and resuming discussion on properly managing payroll...

Manage Payroll: Ministerial Tax Status

Ministers receive a very different tax treatment than nonminister employees.

Even though ministers are considered an “employee” of the church...

the IRS considers ordained ministers to have a dual tax status.

Which means a

minister is considered an employee for federal income tax purposes and

self-employed for Social Security and Medicare purposes.

A

church should not withhold and match Social Security and Medicare taxes

(FICA) from a minister's wages. A qualifying minister also is eligible

for tax saving benefits such as a housing allowance.

Remember the 5 factors the IRS looks at to determine if someone should be classified a clergy for tax purposes:

- Be licensed or ordained

- Administer the sacraments of the church (weddings, funerals, baptisms, and communion, etc...)

- Be considered a religious leader by the church

- Conduct religious worship

- Have management responsibilities in the church

You need to keep supporting documentation on file to support why you classified someone as a minister. Two such documents could be copies of their ordination or any licensing documentation and their position description.

Spreadsheet Package

This spreadsheet package is designed for churches and nonprofits.

It includes:

- Contribution Tracker;

- Automatic Accounting (tracks income and expenses for up to 5 funds);

- Bank Reconciliation (reconciles accounting workbook to your bank statements);

- Collection Count sheet;

- Mileage log;

- Travel reimbursement

- Customizable Word doc with a Cash, Noncash, and a Quid Pro Quo Contribution Receipts.

Manage Payroll: IRS Forms W-4 and I9

These forms are so important as it would probably be one of the first things an auditor would request to look at.

You must have fully completed W-4 and an I9 form on file for every employee!

See Step 5 in this Payroll Guide for more information on those forms.

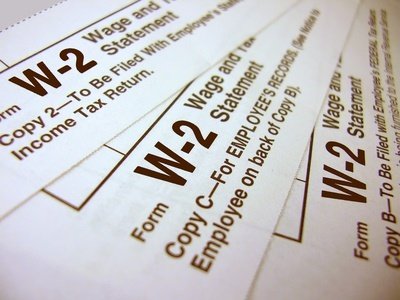

Manage Payroll: Forms W-2/W-3

Another important document an auditor would request to see is copies of your W-2 and W-3 forms. See an example of a minister's W-2.

Make sure you have them on file.

Side point: Your W-2 should always match your quarterly 941 Forms. If they don’t, you’re going to hear from the IRS.

Which leads me to my next point…

Manage Payroll: General Ledger

Your general ledger must match your W-2s.

An auditor should be able to reconcile the data on your W-2 forms to the general ledger.

For example, if your general ledger shows you issued your pastor checks totaling $55,000 for the year and his W-2 only shows $32,000...

your general ledger should show what those additional $23,000 in payments were for and if they were taxable or nontaxable or properly classified and posted.

Housing Allowance payments (reported in either box 14 of the W-2 or in a church issued letter) and nontaxable expense reimbursement payments (under a qualified Accounts reimbursement Plan) could have been part of that compensation amount.

Your accounting should note and reflect all payments. Don't rely on your memory. Carefully note what every payment is for.

Manage Payroll: Employee’s Reimbursement Payments

Another area where auditors carefully scrutinize is employee’s reimbursement payments.

These payments are taxable to the recipient if no qualifying Account Reimbursement Policy is in place and should be included on their W-2

If you do have such a policy in place, review it now. It should be written. Read more requirements needed in order for an AR Policy to be considered a qualifying plan for employee reimbursement payments: Accountable Reimbursement Plan

However and this is a big “however” … if you do not have proper supporting documents backing up the reimbursement claims, the reimbursements could be considered income for the recipient and if not reported … could incur penalties as unreported income.

Remember this very important rule … reimbursement request MUST be made within 60 days of when the expense occurred to be considered a nontaxable employee reimbursement payment!

Manage Payroll: Staff Gifts and Property Transfers

A couple days ago I received this email from one of my readers, “A couple of our church employees were given a restaurant gift card for a small amount $50 - $75). They were both as a thank you for doing a good job. Should this amount be included in payroll?"

My reply was that she should include it the employees’ wage reports.

Unfortunately the IRS has decided that cash can never be a de minimis fringe benefit since it is not unreasonable or administratively impracticable to account for its value. The same thing goes for cash equivalents such as gift certificates or gift cards.

Read more about Staff Gifts

The transfer of church owned property to their minister or staff member as a gift is also considered taxable income.

For example, your church purchases a new computer and decides to give the Pastor the old one. This is fine if… the fair market value of that church owned property is recorded as taxable income for your Pastor.

Manage Payroll: Church Owned Vehicles

If your church owns a vehicle you should be keeping records of everywhere that vehicle goes and for what purpose.

You can bet if you are in a payroll tax audit and your church owns any vehicles, the auditor is going to want to see mileage logs. They know that many times those vehicles are used for personal use.

So…if your minister and staff have used the church owned vehicles for any personal use, you must calculate the value of those personal miles and reported as taxable income on their W-2 form.

Ok by this time your head is probably ready to explode and you are thinking…will she ever shut up:)

I'm through...for now:)

But this will give you a starting point for right now. Start today reviewing how you manage your payroll and make sure that if your organization is ever given notice of an IRS payroll tax audit…you will be ok!

One last tip, according to Dan Busby in that article I was telling you about in Church Finance, if the IRS does come knocking …call your CPA or other tax professional before you do anything.

Resource:

Watch this informative video by Richard Hammar on 10 Common Payroll Tax Errors

Reference:

Church Payroll Tax Audits written by Dan Busby

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!