Chart of Accounts for a Church

A chart of accounts is simply a list of the accounts and numbers you set up to use in your accounting system. It is the foundation for your entire accounting system, so it is very important...but always remember...it is also ever changing...

Coupon!

Here is a 10% discount code for all the ebooks, spreadsheets, and packages on this site:

FCA

Note: click on "PACKAGES" in the top navigation bar for a list of all of the ebook and spreadsheet packages on this site!

A COA (chart of accounts) typically lists your balance sheet accounts first:

ASSETS

WHAT YOU OWN

LIABILITES

WHAT YOU OWE

EQUITY

NET ASSETS

Then it lists your Statement of Activity (Income Statement) accounts:

INCOME

MONEY YOU GET

EXPENSES

MONEY YOU SPEND

As I stated in the beginning of this article, a chart of accounts in a list of your particular church or nonprofit's account and account numbers.

Even though each organization's chart of accounts is unique, most nonprofit and churches use a universal numbering system to avoid confusion for your staff, bookkeepers, accountants, and financial institutions.

Check out more about that numbering system and COA tips and using QBO for a church in this Youtube video: QuickBooks Online Tips for Churches

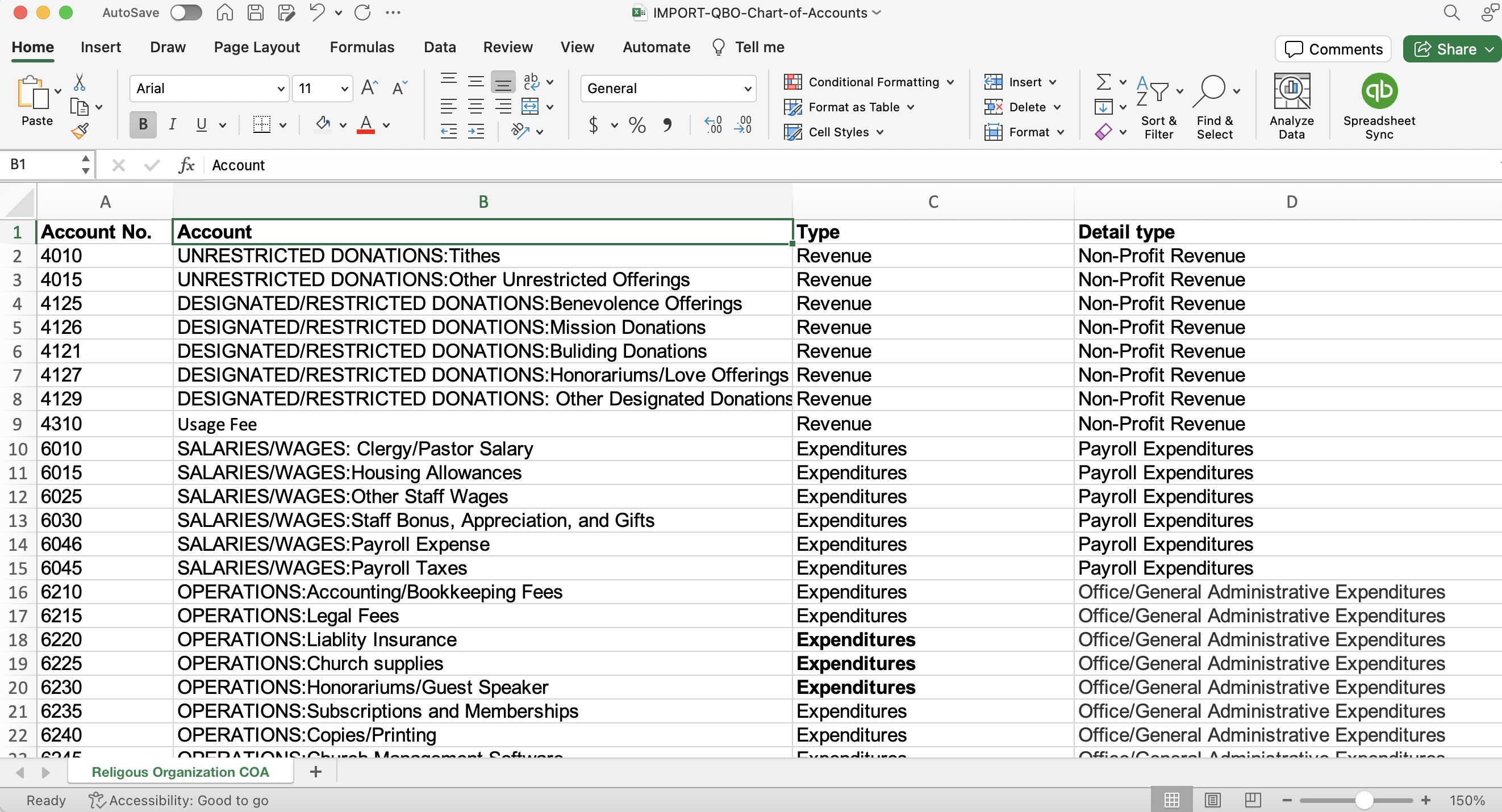

Need a Chart of Accounts for a Church for your QBO file?

Already formatted to upload to your QBO file if it has been set up for a church or nonprofit. The terminology for the account "type" is different for a "for-profit" business and nonprofits .

To see if your QBO account is set up for nonprofit, look for 2 things:

- In reports, your profit and loss report will be titled: Statement of Activity

- In the Chart of Accounts, the "Account Types" will be labeled "revenue and expenditures" instead of "income and expenses"

If you are seeing the "for-profit" terminology, contact me and I will tell you how to fix it.

See this video on how to import this chart of accounts and how to manually create more accounts in QBO: How To Import Chart of Accounts Using QuickBooks Online

Only $5.00!

Standard Numbering Convention:

1000'S

ASSETS

2000'S

LIABILITIES

3000'S

EQUITY

4000'S

INCOME

6000+

EXPENSES

Account numbers are often five or more digits in length with each digit representing a division of the company, the department, the type of account, etc.

The account numbers are usually 5 or more digits, so we can break out those main category of numbers into more detailed groups.

Note: if you did an internet search on chart of accounts (COA) numbering...you would find the basic number system above...but when you start drilling it down...you will see a variety of numbering systems. All will appear in the same order (eg: ASSETS: Cash, Undeposited Funds, Receivables, Current Assets, Fixed Assets, etc.) BUT the number grouping will be different, so just remember you can use any numbering system you deem appropriate. Just use the main number used universally and using the remaining digits consistently.

For example:

ASSETS:

1000 - 1199: Cash and Investments (list your bank account(s) first then investments)

1200 - 1299: Undeposited funds (use this if you are using QuickBooks or something similar)

1300 - 1399: Receivables (if you were using an accounting software such as Aplos...you would probably use 1200s)

1400 - 1499: Prepaid Assets (eg: insurance, postage, etc.)

1500 - 1699: Current Assets

1700 - 1799: Fixed Assets (eg: Land, Buildings, Equipment, etc.)

1800 - 1899: Accumulated Depreciation (if you track depreciation)

1900 - 1999: Other long term assets

LIABILITES:

2000 - 2499: Current liabilities (obligations payable within one year {eg: credit cards, account payables, payroll payables}

2500 + Longterm liabilities (eg: mortgage payable and vehicle payable)

INCOME:

4000 - 4199: Donations and Support

4200 - 4299: Pledges

4300 - 4399: Grants

Again...this is just an example. Use your own group numbering for these 4000s...just be consistent.

5000s are another example of different organizations using different numbers. Some churches and nonprofits use them for earned revenues such as program service fees, membership dues, fundraisers, interest, fixed asset sales. BUT most organizations use 5s for expenses.

EXPENSES:

6000 - 6999: Operating/Functional Expenses (eg: facilities, salaries, administration, etc.)

The 6000's operating expenses can be grouped even more detailed with group or parent accounts such as Administration, Payroll, Facilities/Grounds, Programs/Ministries, etc.

7000 - 7999: Non-operating Expenses: (eg: missions, ministries, etc.)

8000s: Ask My Accountant: a place to record transactions you don’t know what to do with and you want to review with your accountant reassigned.

Church Accounting Package

A set of 2 ebook packages that covers the following topics...

- Fund accounting examples and explanations

- Difference between unrestricted and restricted funds

- Best methods for tracking restrictive funds

- Explanations and examples of financial statements for churches and nonprofits

- Minister compensation and taxes

- Payroll accounting and its complexities

- Much more - Click here for details

Chart of Account Naming and Numbering Tips

As mentioned at the start of this article, your chart of accounts serves as the cornerstone of your entire accounting system. It is advisable to begin with a simple setup, only including the accounts currently in use, as a chart of accounts is an evolving tool.

Here are some tips to consider while developing your chart of accounts:

- Adding accounts is easier than deleting them.

- Avoid using specific names like ABC dues, Dropbox, and Amazon Prime; opt for generic account names such as "Dues and Subscriptions." Most accounting software allows you to generate detailed vendor reports.

- Utilize sub-accounts to specify donations and expenses, then consolidate these accounts for more general reports.

- Use tags in Aplos to identify and track specific items for reporting purposes instead of creating multiple funds.

- Avoid overusing classes in QuickBooks to track a broad range of items. Instead, utilize the "Customer" field (if not tracking donors in QBO) to monitor designated donations, events, and fundraisers.

- Prevent duplication of efforts. For example, refrain from creating numerous income accounts for various fund donations and subsequently using "classes" or "funds" to monitor the same categories.

If you plan to use QuickBooks Online, consider referring to Lisa London's "Accountant Beside You" books for guidance on chart of accounts and QBO setup. Additionally, Lisa London offers online courses that you can follow while configuring QBO for your church or nonprofit organization.